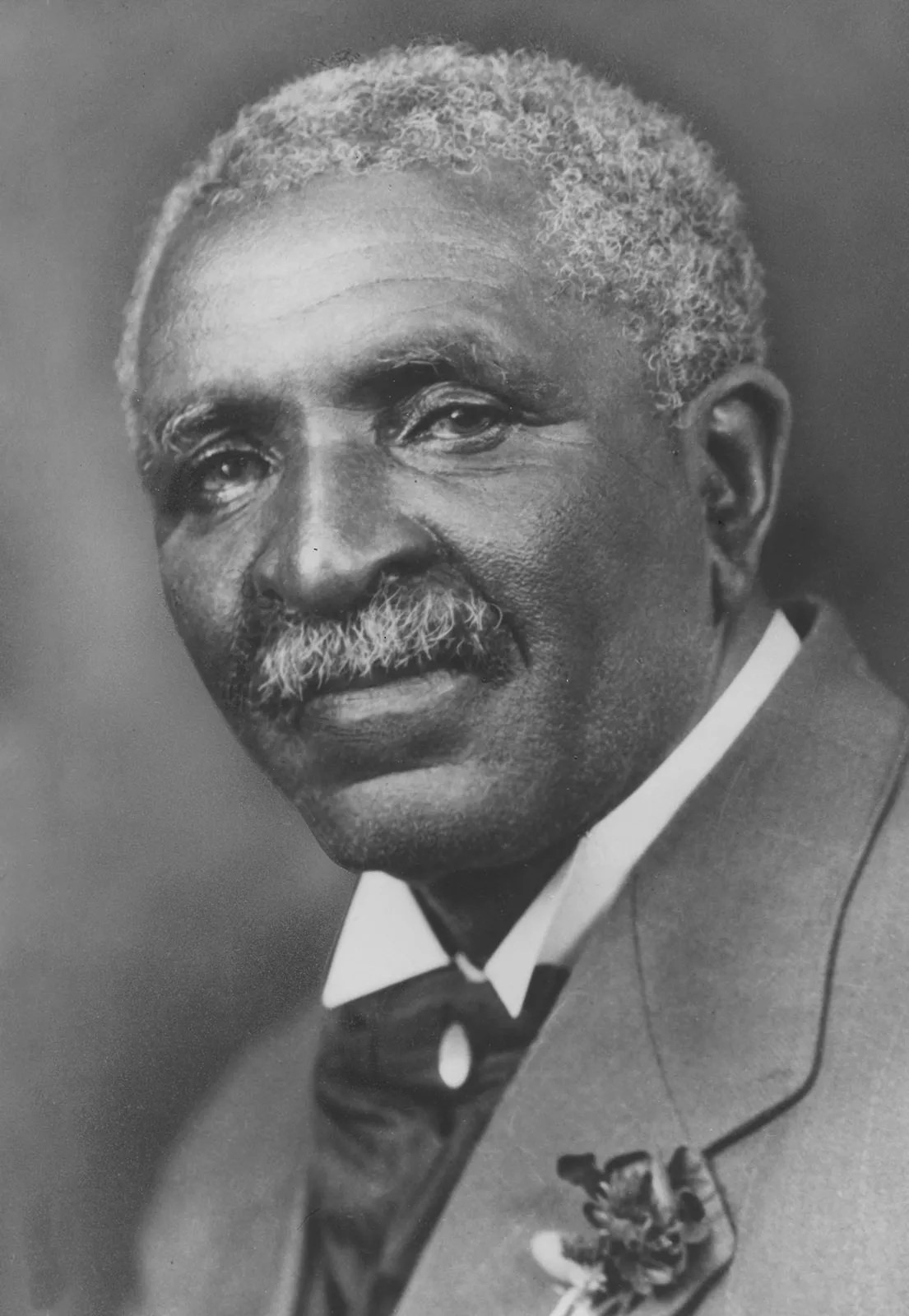

Jesse Binga

Jesse Binga’s rise from relative poverty to become the wealthiest African American entrepreneur and banker in Chicago in the late 19th century earned him a national reputation. Binga was born on April 10, 1865, in Detroit to William W. Binga, a barber and native of Ontario, Canada, and Adelphia Lewis Binga, the owner of extensive property in Rochester and Detroit. He dropped out of high school and at first collected rents on his mother’s property in Detroit. He later moved to Seattle and Tacoma, Washington and then Oakland, California, working as a barber in each city. Binga also worked as a Pullman porter and during that time acquired property in Pocatello, Idaho which he profitably sold. Binga finally settled in Chicago in 1893. His first real estate ventures were relatively modest. He began by purchasing run down buildings, repairing, and renting them. By 1908 Binga had built up enough wealth that he was able to establish a private bank. Binga also married Eudora Johnson who provided him with additional assets and considerable social prestige. As the African American population of Chicago began to grow in the first two decades of the 20th Century Binga opened the Binga State Bank in 1921 with deposits of over $200,000. Within three years the bank had deposits of over $1.3 million. Binga, now the owner of a number of South Side Chicago properties, was also a leading philanthropist.

The Binga State Bank provided Chicago’s African American community with an option other than relying on the large white-owned banks, which often discriminated and with predatory lenders who often entrapped working class black residents who wanted to purchase homes or establish businesses. The bank also employed a number of African Americans in rare, well-compensated white collar occupations and created a sense of pride and achievement in African American community business ventures.